Revenue Management for Exchanges and Other Financial Data Providers

Scroll or use the menu below to navigate through the article 👇

Challenges for Exchanges and Data Vendors 🤔

Monetization of market data and other financial information is a major source of revenue for exchanges, electronic trading venues and data vendors. But these organizations are often dependent on each other to deliver their data products to end-consumers, making direct client relationships complex.

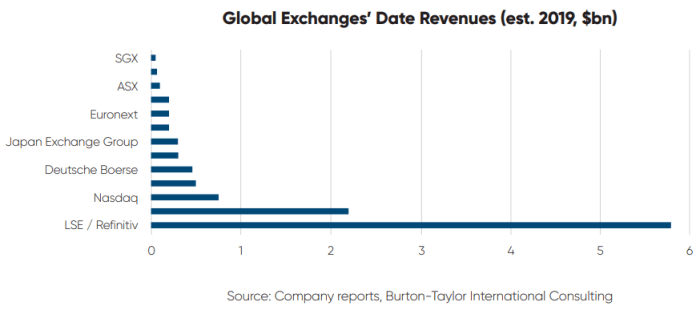

At the same time, the industry is witnessing a growing number of vertical (and in some cases horizontal) mergers that bring together exchange operators and the vendors that distribute their data to financial services clients 👩💻

This trend – illustrated by recent or ongoing mergers between the London Stock Exchange and Refinitiv, SIX and BME, and ICE and Interactive Data – is primarily being driven by the belief that the combination will create value that is greater than that derived from the two separate entities.

But the fact that these tie-ins bring exchanges closer to the final consumers of their data services should not be under-estimated.

For those exchange operators and data originators that remain independent, the absence of a direct connection to their data customers means that many struggle to understand who within financial services institutions are using their information and for what purpose.

Add to that the continuing use of manual and error-prone administrative processes, and the result is that many data originators have difficulty in policing licensing agreements with end consumers, and in some cases are unable to control access to their services.

“This places responsibility with the data vendor to ensure their customers – whether consumer firms or re-distributors – comply with the originators’ policies.”

To address these issues, data producers and data vendors often deploy sales executives to establish some form of direct client relationship – both to sell more product but also to ensure compliance with access and reporting procedures.

But these efforts often produce mixed results due to the sheer volume of data consumers, which stretches under-resourced sales teams.

The result is a lack of transparency with respect to client usage, which is more widely detrimental to the customer relationship 🕵️

The absence of insight into how clients are using their services can stunt product development, resulting in low customer satisfaction and low levels of innovation. As well as leakage of revenues.

Exchanges’ difficulty in monitoring client compliance with their licensing agreements means it can be a challenge to identify customer reporting issues outside of full-scale audits, which are cumbersome, require a lot of work on the part of the client, and ultimately can be damaging to customer relations.

Finally, with little or, at best, limited actionable data on clients’ use of their products, exchanges and data vendors often have no central repository that can be used as the foundation for automating market data business processes.

This hinders innovation in market data invoicing, entitlements, compliance and wider administrative functions.

Again, this can complicate customer relations and hamper efforts to monetize the valuable data sets produced by exchanges’ and data vendors’ core activities.