Market Data Usage Monitoring: Current Landscape 🔧

(back to top)

Today's financial services firms have complex information solution needs. It's the market data managers job to ensure the right services are contracted for and used within the organization.

However, this is often much easier said, than done.

Most market data managers are effectively ‘flying blind’ when it comes to how and where information is being consumed, making it difficult to prioritize renewals or cancel unused services.

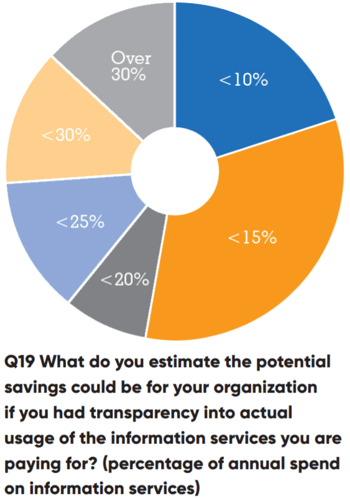

In fact, two-thirds of respondents said their organizations did not have sufficient transparency into the actual usage of the information services they pay for across their firm.

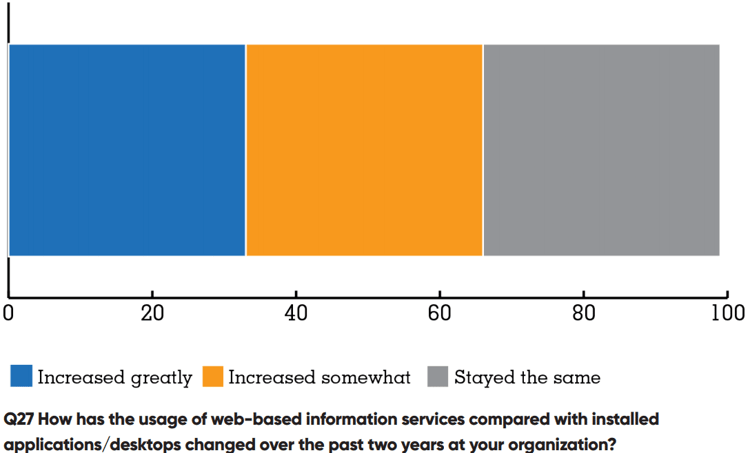

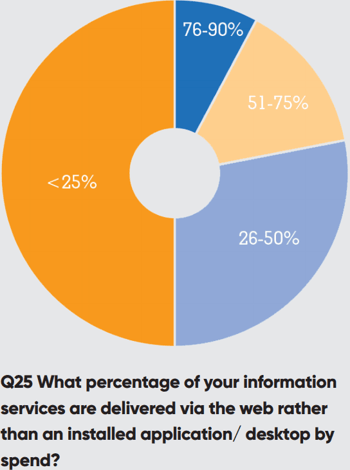

These information services can range from the traditional data feeds supplied by vendors such as Refinitiv and Bloomberg, to more specific information sources supplied through a website or other web-based delivery mechanism.

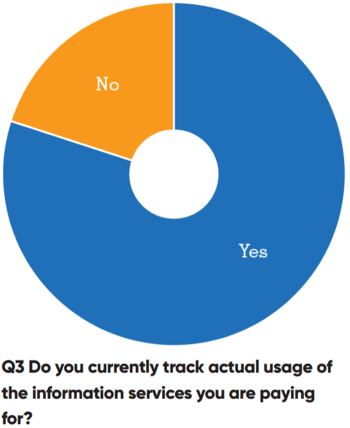

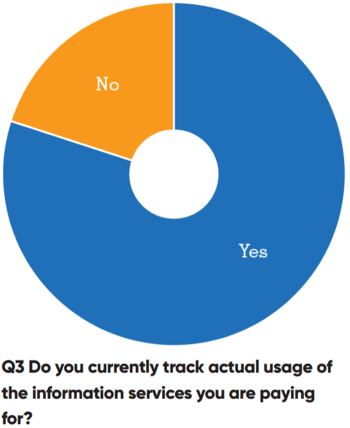

Certainly, this has been a concern for some time for market data managers. Many are able to track some aspects of usage – in fact, nearly 79% of respondents to the survey say they currently track actual usage of the information services their organization is paying for in some way.

However, of those who are tracking usage, half do so by simply asking end users about their usage patterns, while the other half rely on vendors to supply usage information.

However, vendor usage tracking information is limited 📊

“The two main desktop app companies – Refinitiv and Bloomberg – supply limited tracking capabilities within their own products.”

Refinitiv offers the Data Access Control System (DACS) and Bloomberg has the Entitlements Management and Reporting System (EMRS).

Unfortunately, the usage information can often not be what the market data manager needs. Says one respondent, “Usage stats from vendors are not always good. Transparency depends on granularity of data provided by suppliers.”

Another frequent issue is that usage statistics from vendors come in different formats, so organizations need to spend time and resources to aggregate usage data manually – and even then, comparative analysis can be difficult.

As well, beyond these two services, vendor usage data coverage can be patchy. Most vendors don't provide any kind of usage tracking," says one respondent.

“They might have [this kind of tracking in their systems for their own internal use] but don’t want to offer it to their clients.

Outside of Refinitiv and Bloomberg, there is really no way to track actual usage for anything we have internally.”

This market data manager, like so many others, has to rely on internal self-assessments of information services use to gauge purchase and renewal decision.

The respondent continues, “Mostly we send monthly inventory reports to the business heads and ask them to review those, see what’s being used in their individual business areas, and let us know if anything is no longer required.”

“Other respondents said they sent their requests for information to the business semi-annually, or even annually”

Unfortunately, these types of manual assessments can be subject to “gaming” by the business. For example, if charge-back to the business is determined through the information supplied in them, the business line manager may be tempted to underreport use of certain information solutions relative to other departments.

Alternatively, managers who do not pay directly from their own budgets may not be engaged in the process enough and simply rubberstamp through the use of some solutions that are really not being used at all.

Another respondent says his firm uses a combination of a usage tracking tool, vendor data, and manual processes.

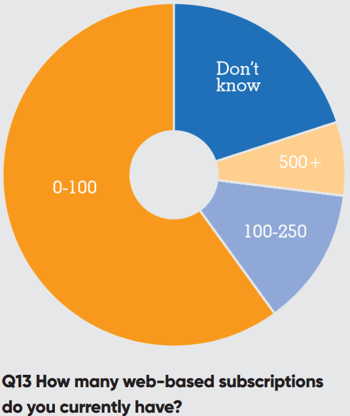

However, he cites a common problem with many of the newest sources of information that financial services firms require for their business. “Anything with a .com at the end is difficult,” he says. “We have to rely on the vendor for these and it tends to happen when contracts are up for renewal.

“Some vendors, like Fitch, we take through various mechanisms, including web-based and feeds, so it’s hard to track overall consumption.”

Plus, when feeds go into internal systems, then it’s impossible to track the output in terms of derived data.”

Even when some data – either for a desktop service or for a web-based product – is provided, usually it is not to the level of granularity that organizations need to allocate internal costs to teams or departments.

This also usually means the information provided is not useful for internal reporting purposes.

Many organizations spend significant time and effort to create internal cost centre reports for their subscriptions.

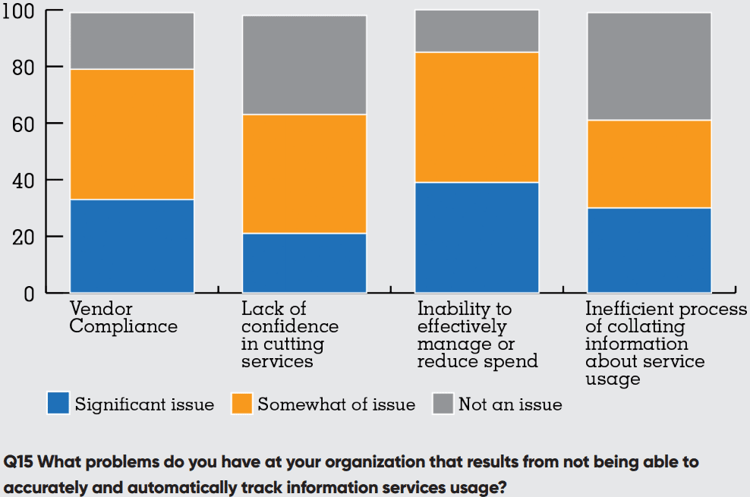

The frustration felt by market data managers is evident.

One respondent summed up his firm’s approach by saying simply, “Could be better.” Says another, “We can’t actually track what sources are being used or not, and to what extent.”