Reference Data Management for Financial Institutions

“The case for enhanced reference data transparency, control and governance.”

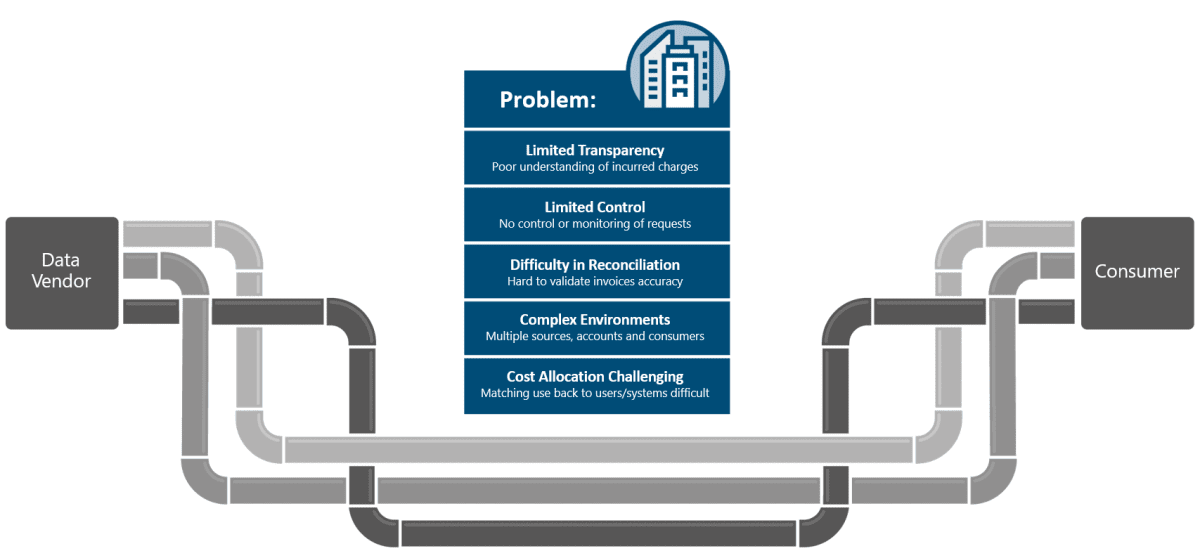

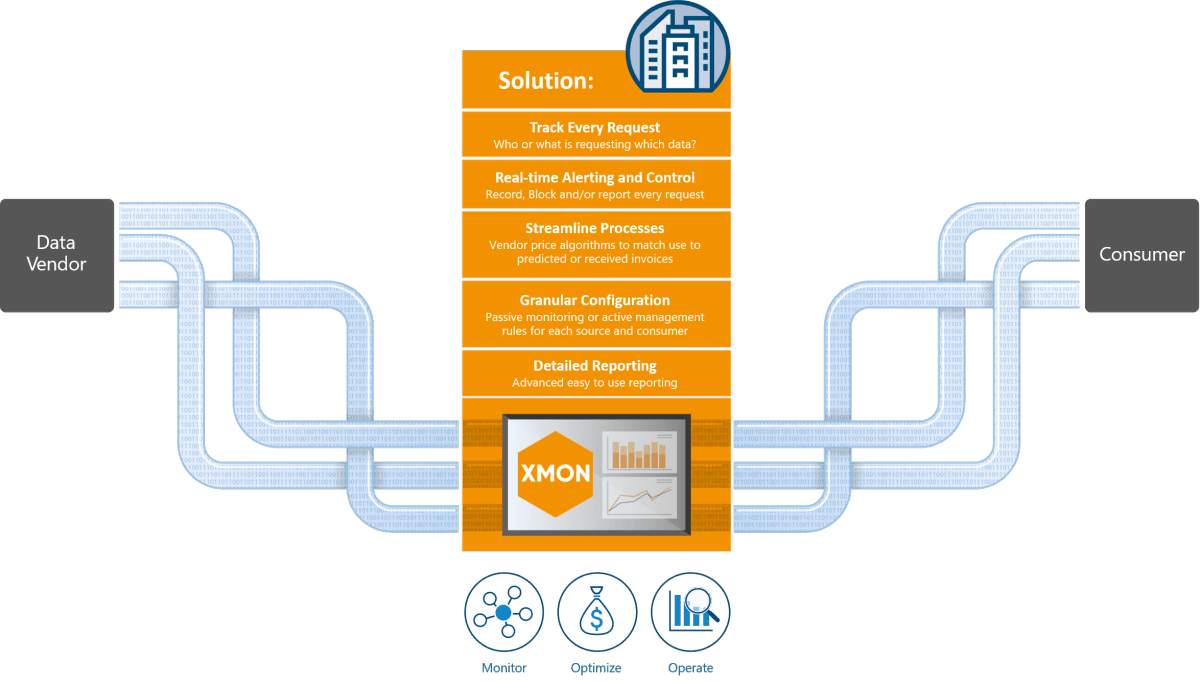

Financial institutions continue to struggle to track usage and implement controls over reference data and other valuable enterprise information, leading to a lack of visibility and understanding of how services are being used by staff, teams, business units and IT applications.

This can have expensive and potentially damaging consequences, in terms of unexpected invoices and possible financial penalties for noncompliance with suppliers’ licensing agreements.

In particular, it can make it difficult to reconcile usage with invoices, making it hard to verify the accuracy of data suppliers’ bills and hard to apply accurate cost allocations 💰

Without an understanding of who is using these data services, firms are unable to determine the value they derive from their reference data subscriptions and manage data budgets.

What’s needed is a proactive approach to usage tracking so that firms can implement controls on access, ensuring accurate cost allocation and value for money from data investments.

Scroll or use the menu below to navigate through the article 👇