These are key findings of a new global survey of how firms are managing the increasingly complex and costly data on which they rely.

The WatersTechnology poll of 50 senior data and technology staff at buy-side and sell-side institutions provides a unique insight into the challenges firms face, and how they plan to tackle them.

Sources of data proliferated during the Covid-19 pandemic, and costs are expected to rise from current record levels. Meanwhile, the rise of hybrid working has made tracking usage and compliance more complicated – even as data management budgets are squeezed.

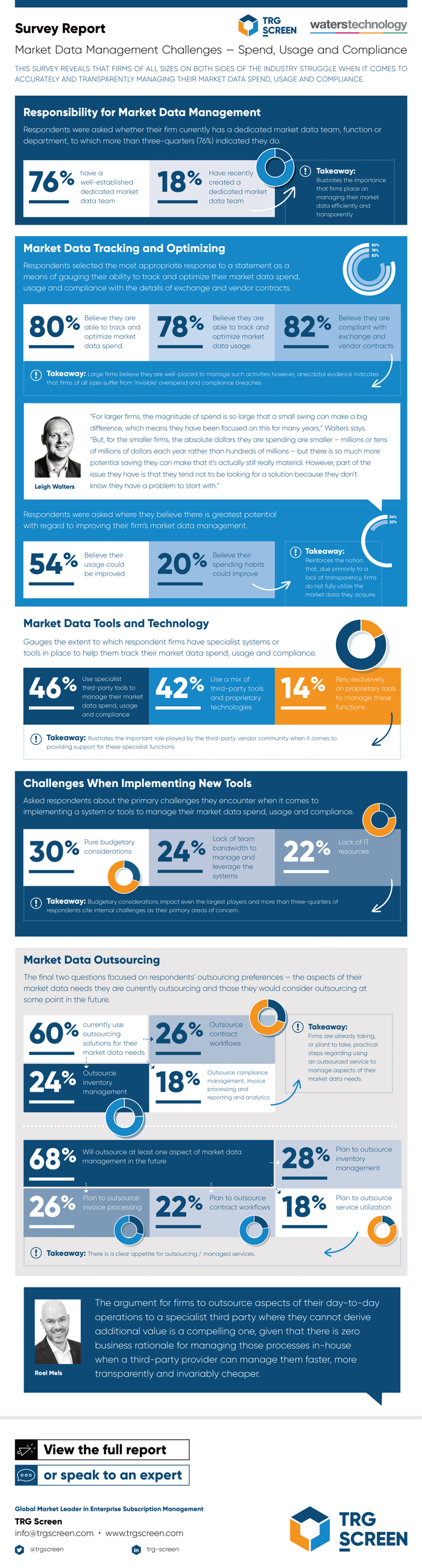

Accurately and efficiently monitoring data spend, usage and compliance is a laborious and error-prone task, especially for firms that try to do it manually. Large(r) firms believe they are well-placed to manage such activities however, anecdotal evidence indicates that firms of all sizes suffer from ‘invisible’ overspend and compliance breaches.

Market Data Tools and Technology

The survey shows that while 46% of firms use third-party tools to manage data and a further 42% use a mix of third-party and proprietary tools, one in seven rely on their own technology.

Asked about the challenges of implementing new tools, 30% of respondents cited budgetary considerations, 24% said their teams did not have the bandwidth to manage and leverage the systems and 22% said they lacked IT resources.

Outsourcing the Market Data Management function

But change is in the air, with 60% of respondents saying they already outsource some of their data management functions and 68% saying they plan to outsource one or more aspects of their data needs in the future. Management of inventory (28%) and invoice processing (26%) were the leading candidates for outsourcing.

Leigh Walters, Chief Operating Officer of TRG Screen, a global leader in data subscription management, said that while large firms had, over the years, learned to keep tabs on their spending, they were less able to track usage and compliance.

“Most try to handle their compliance manually but they lack the understanding around usage patterns and contractual rights, which exposes them on the compliance front,” he said.

Smaller firms, which made up 28% of those surveyed, spent less on data but, Walters said, could make significant savings. “However, part of the issue they have is that they tend not to be looking for a solution because they don’t know they have a problem to start with.”

While the largest institutions were seeking incremental savings and trying to eliminate areas that did not add value, smaller firms – even after they realize they have a problem – could lack the internal resources to tackle it.

“That’s where we become a one-stop shop for them, where, rather than hiring a market data team and buying the tools to manage those functions, we do everything for them,” Walters said.

This chimes with the survey’s finding that use of managed services in market data management is expected to expand appreciably.

Market Data Management Challenges — Spend, Usage and Compliance

The survey concludes that consumers saw room for improvement in market data spend, usage and compliance management. Roel Mels, TRG Screen’s global head of marketing, said that for firms to truly optimize their data, they needed the whole picture.

“If you have a clear picture of spend and usage across the business, not only can you better manage your market data spend, but you will actually optimize it. What does spend tell you if you don’t have the actual usage stats behind it? Monitoring usage also helps you mitigate risks in terms of compliance,” Mels said.