It refers to the ability to understand how commercially supplied data sets may be consumed or redistributed within a financial institution, with the intention of ensuring that firms are not at risk of falling out of compliance with the licensing agreements they hold with data vendors.

While Rights Management may be seen in the context of the broader Know Your Vendor/Supplier initiative, which aims to mitigate risks to supply chains in the event of a supplier default, for financial firms the fear of audit is a major driver. The costs involved in an audit of firms’ financial

data usage have been highlighted by a number of public instances involving well known institutions. The financial penalties that resulted, as well as the significant reputational damage, appear to have sparked firms’ awareness of the issue of non-compliance with licensing agreements.

So companies continue to struggle to proactively managing vendor relationships

through Rights Management. But how can firms act now to protect themselves from non-compliance with vendor licensing agreements?

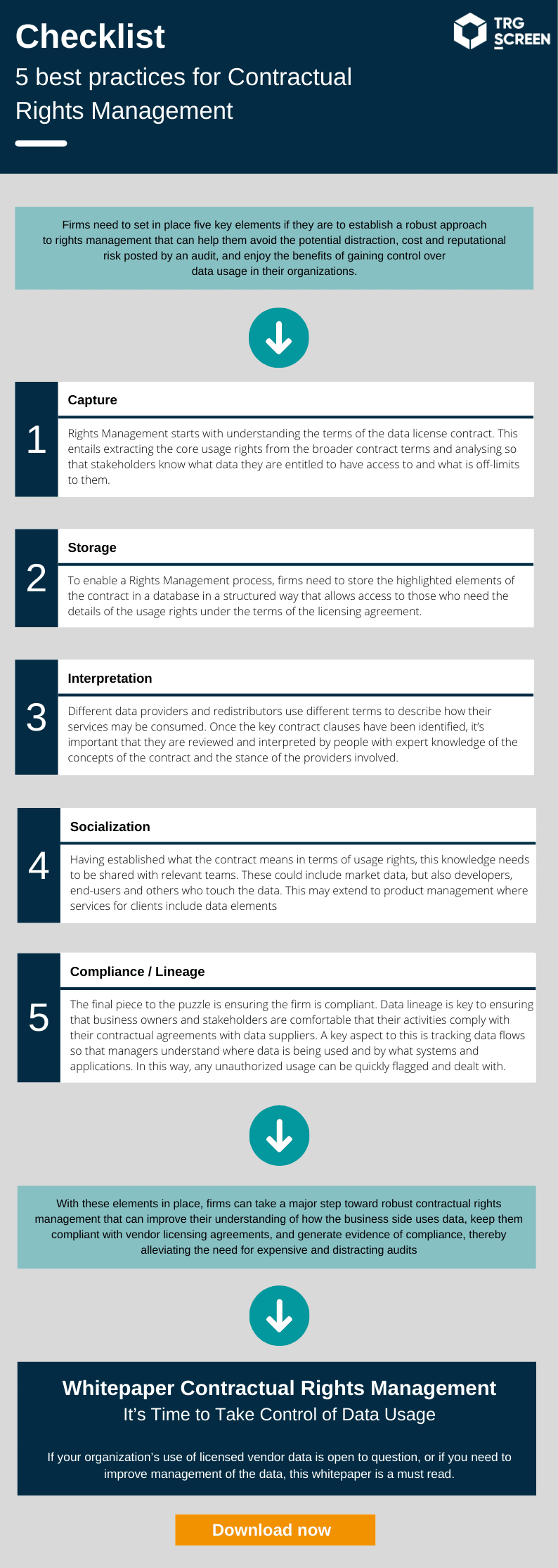

Checklist: 5 best practices for Contractual Rights Management

Firms need to set in place five key elements if they are to establish a robust approach to rights management that can help them avoid the potential distraction, cost and reputational risk posted by an audit, and enjoy the benefits of gaining control over data usage in their organizations.

(View checklist as PDF)

Conclusion

With these elements in place, firms can take a major step toward robust contractual rights management that can improve their understanding of how the business side uses data, keep them compliant with vendor licensing agreements, and generate evidence of compliance, thereby alleviating the need for expensive and distracting audits.

Want to learn more on how to take control of data usage through digital rights management?