Online compliance database of market data policies & pricing information

PEAR is an industry-leading exchange compliance database

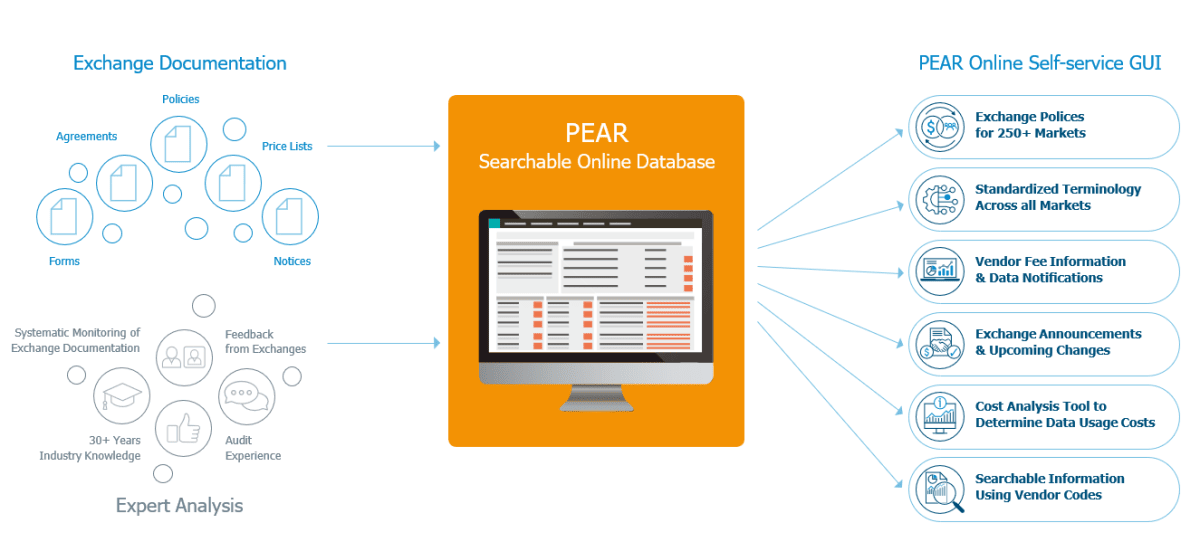

PEAR (Policies, Explanations, Analytics, Repository) consolidates the latest exchange information which includes policies and pricing in a searchable online database.

Globally, it allows you to keep up to date with the latest exchange policy trends and interpretations.

Simplify your market data management processes

PEAR covers over 250 markets and monitors over 700 documents and exchange notices daily. This ensures clients are notified of any changes to rules, prices and policy interpretation. PEAR applies standardized searchable terms across global exchange policies – reducing complexity and risk from different interpretations.

Ensure compliance with your market data usage

Understanding the rules and pricing around market data can be complex. With PEAR, you are provided with information surrounding exchange products – including the fees for accessing and distributing data, as well as understanding how to use the data compliantly.

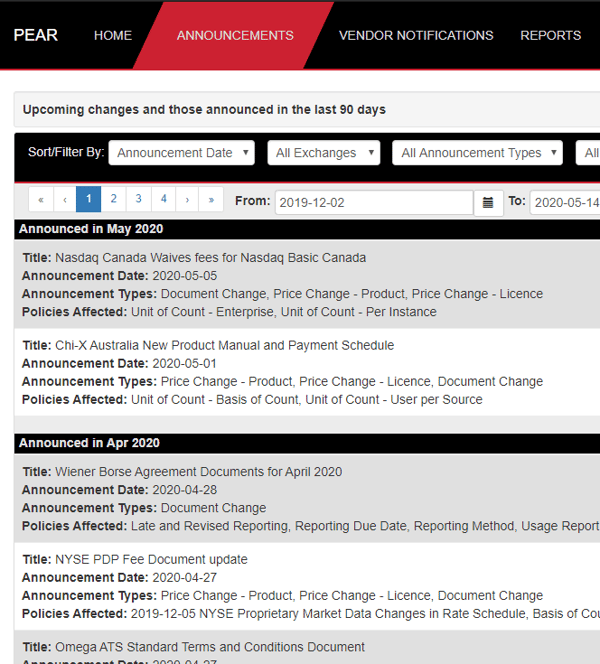

Automate the workflow of managing your exchanges' updates

Keeping up to date with the various price and policy changes made by exchanges can be a challenging task. PEAR simplifies this process by automatically sending out exchange announcements, providing you with details on changes across the global list of exchanges.

Optimize your market data compliance

Many financial institutions – large and small – struggle to understand and keep informed with various price and policy changes made by exchanges. PEAR is designed to specifically solve this problem.

How to keep up to date with all the policy and price changes made by exchanges?

Today, one of the biggest problems facing market data professionals is keeping up to date with the various price and policy changes made by exchanges. With a heavy reliance on vendors and subscribers to inform their client base, there is always a risk of the message becoming lost in already overloaded inboxes. This typically results in data subscribers having to seek this information for themselves.

The solution is to have access to an industry-leading database of market data policies and pricing managed by a dedicated team of experts. With an intuitive design, PEAR has a homepage for each exchange giving you access to sections on products, policies and copies of documents.

This approach simplifies the process of market data management – allowing users to pinpoint the single piece of information that they require, or compare policies and pricing from multiple exchanges within the same interface.

500+ happy market data professionals world-wide

Our global footprint of clients ranges from Tier 1 investment banks, through hedge funds, to exchanges. And yes, we’re pretty proud to be serving 80% of the top 15 global banks in the world.

Ready to analyze and keep up to date with exchange policy and price changes?

Learn how you can optimize your market data compliance processes.

How PEAR can help optimize your market data compliance

Granular Structure

PEAR maps market data exchange policies at product level rather than Exchange level, allowing users to access targeted guidance to their queries.

History

Previous exchange market data policies, agreements, pricing and announcements are maintained within PEAR.

Cost Analysis Tool

‘What If’ is our cost analysis tool, allowing users to determine how much specific datasets and markets would cost to implement.

Vendor Data Notifications (DNs)

Up-to-date DNs stored in PEAR for customisable queries, personalised workflow and links to associated exchange policies and announcements.

Licence Picker

This feature applies a simple colour-coding process to highlight the licences a firm holds and the products they use.

Document Comparison

The ‘comPEAR’ tool gives clients the ability to perform side by side comparisons of previous and current exchange documents.

PEAR API

Allows programmatic access to the information held in the database for use in other systems and workflows.

Integration with Optimize Spend

PEAR's integration with our spend management platform gives users a complete view across all aspects of their market data subscriptions.

Get in touch

PEAR provides financial institutions with the latest exchange information – including policies and pricing – in a searchable online database.

Exchange compliance & reporting

Other Axon products & services

Key Benefits

- Policy management

- Secured compliance & reporting

- Market data knowledge & expertise

Get in touch

Ready to optimize your market data and subscription spend & usage?

ROI calculatorBlog & news

Contact us

United States (Global HQ)

1 Pennsylvania Plaza

3rd Floor

New York, NY 10119

All international offices- Privacy policy

- Copyright © 2024 TRG Screen