Driving efficiency in market data reporting

ADS is an outsourced solution for exchange & vendor reporting

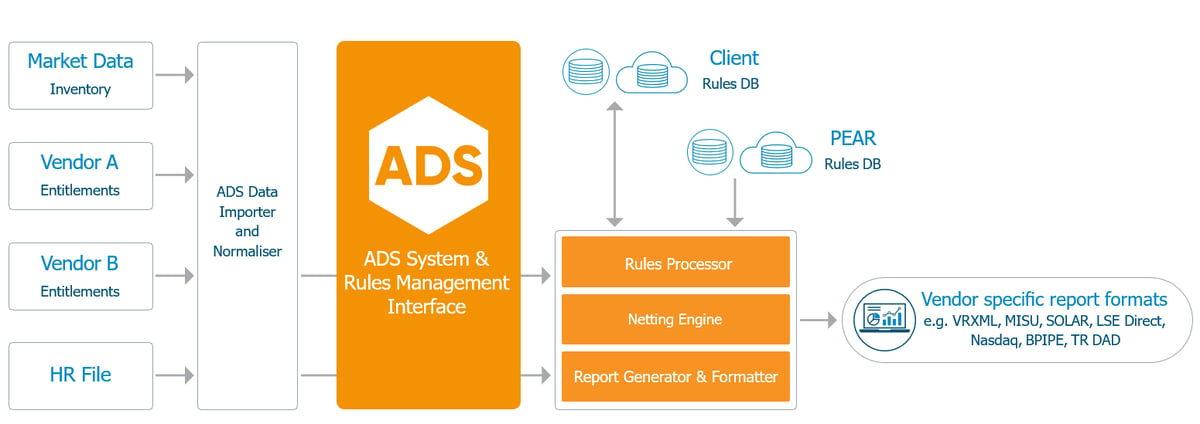

ADS (Axon Declaration Service) provides firms with outsourced management of the market data declaration process – carried out by automated processes overseen by market data experts who provide analysis around the ever-changing market data policies.

Globally, it helps firms with the ever present need to control market data costs whilst ensuring compliance with exchange policy.

Automate your market data usage reporting process

Systematic approach improves declaration accuracy by removing repetitive manual processes, reducing the risk of human error when interpreting exchange policies – while leaving you in control of the workflow and approvals.

Ensure compliance with exchange policies

Interpreting exchange policies can be a challenge. ADS ensures compliant reporting in accordance with exchange policies and unit of count whilst aiding in the mitigation of future audit risk – delivering full transparency in how end users and applications are reported.

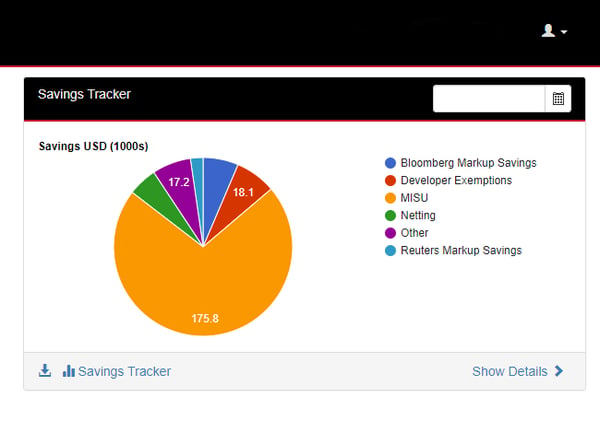

Cost savings through netting programs and fee waivers

On average typical clients can achieve savings of between 6%-8% of their exchange market data spend across MISU, natural person reporting, role based exemptions, vendor admin fee savings other netting programs.

Optimize your market data usage reporting

Many financial institutions – large and small – struggle with the time-consuming and repetitive manual processes associated with reporting their usage to exchange and vendors. ADS is designed to specifically solve this problem.

Is managing your exchange and vendor reporting processes a challenge?

Exchanges are introducing ever evolving policies regarding the use of market data in areas such as non-display, derived data creation and data usage applications. Interpreting and staying up to date with these policies, on top of the labour heavy reporting process can become a challenging task – hours can be wasted manually submitting the exchange/vendor reports when firms internally do not have the skillset to automate the process.

ADS provides a streamlined process that eliminates the time-consuming elements of preparing exchange and vendor declarations. It provides an independent external resource to interpret exchange policies – assisting in reducing and controlling market data costs – giving you great confidence when it comes to compliance and audits.

Additionally, ADS conducts cost benefit analysis of any new netting program to enable the client to measure the costs against potential savings.

500+ happy market data professionals world-wide

Our global footprint of clients ranges from Tier 1 investment banks, through hedge funds, to exchanges. And yes, we’re pretty proud to be serving 80% of the top 15 global banks in the world.

Ready to take control of you exchange and vendor reporting processes?

Learn how you can optimize your market data usage reporting

How ADS can help optimize your market data usage reporting

Control

Interactive workflow provides you with control over the approval and submission of your reports. The ADS dashboard also provides a monthly summary of reports and metrics.

Efficiency

Removes overhead associated with monthly and quarterly reporting obligations leaving high-value resources available to implement more strategic projects.

Rules management

Ongoing management of exchange and client specific rules to produce accurate and compliant declarations whilst ensuring clients benefit from favourable exchange policies where applicable.

Ease of implementation

Flexible system that can accept and normalize multiple sources of data – including exports from well-known inventory and entitlement systems.

Reporting

Production and submission of reports in formats as specified by exchanges and vendors e.g Solar, VRXML, CSV.

Get in touch

ADS provides financial institutions with an outsourced solution for exchange and vendor reporting.

Exchange compliance & reporting

Other Axon products & services

Key Benefits

- Policy management

- Secured compliance & reporting

- Market data knowledge & expertise

Get in touch

Ready to optimize your market data and subscription spend & usage?

ROI calculatorBlog & news

Contact us

United States (Global HQ)

1 Pennsylvania Plaza

3rd Floor

New York, NY 10119

All international offices- Privacy policy

- Copyright © 2024 TRG Screen